DeFi Analytics tools are those which help in comparing different DeFi protocols on the basis of different metrics such as number of active users, TVL on chain, protocol fees, transaction count, etc. Though there are many defi analytics tools, yet only a handful of users know how to use them well.

In this article, I will help you understand how you can use DeFi tools to their fullest potential and make a fortune in DeFi.

Table of Contents

DeFi Analytics Meaning

DeFi Analytics uses blockchain data to understand and gain deep insights into different DeFi protocols in existence. These insights help predict the future of DeFi protocols to a certain extent which then translates into decent profits.

To understand how DeFi analytics tools help you get an edge, let us first explore on what metrics do we usually compare different DeFi protocols.

Common Metrics in DeFi Analytics

I have been trading in Equities and Crypto since the last 8 years (2015-present). Some of the common metrics that I use in DeFi Analytics tools to get an edge over others are listed below with their meaning.

- TVL, the sum amount of money that is locked into DeFi protocols

- Fees, refers to the transaction fees paid to the DeFi protocol

- Revenue, shows the health of a protocol. Usually, the protocols with higher revenue, have more users and hence more liquidity.

- Liquidity, is the measure of how many people trade on a defi protocol at an instant. More users result in faster transactions.

- Number of Transactions (daily, weekly, monthly, etc.)

How DeFi Analytics Work?

These tools read thousands of publicly available transaction records across hundreds of blockchains and record the data typically with a DBMS software. They then present you the data in a tabular or graphical form.

Greater Profits With Combined Machine+Human Expertise

A common way of earning profits in DeFi is through Yield Farming, a method where investors constantly shift their capital to get the highest returns.

However, it is not as easy as it appears. There are more than 3000 protocols and monitoring each one of them on the basis of above metrics is simply not possible.

Therefore, to make matters easy, there are a few tools like DeFi Research by Markus Thielen, which creates custom reports

How Can You Ensure Good Profits With DeFi Analytics?

Good profits only come from knowing everything that affects your investment. In a DeFi environment where there are hundreds of cryptocurrencies and thousands of liquidity pairs, DeFi Analytics help in cutting the clutter.

However, you need to know what to find when using these tools. So, next time when you start exploring DeFi protocols, make sure you watch out for these signs.

Common Signs To Identify Profitable DeFi Protocols

- Popularity of DeFi protocol which is measurable through Sentiment Analysis.

- Revenue and Transaction count both of which signify that the protocol is healthy.

- Fees. Even if the healthiest protocol charges a high fees, it makes it more difficult to get a good return.

- On-Chain Metrics such as

- Number of Total Addresses

- Number of Active Users

- Number of Large Transactions

- In and Out of the Money

- In and Out of Exchanges

- Net Realized Market Cap

Common Mistakes To Avoid

Also, here are a few common mistakes that I have seen DeFi users make is:

- Following peer advice

- Follow investment patterns from Social Media

- Invest at peak euphoria. Typically, that’s the time that you should exit the crypto.

- Chasing risky and penny cryptocurrencies. Volatile crypto can show the growth of your portfolio.

- Selling when markets correct. Typically that is the time when you should invest more.

DeFi Analytics Tools

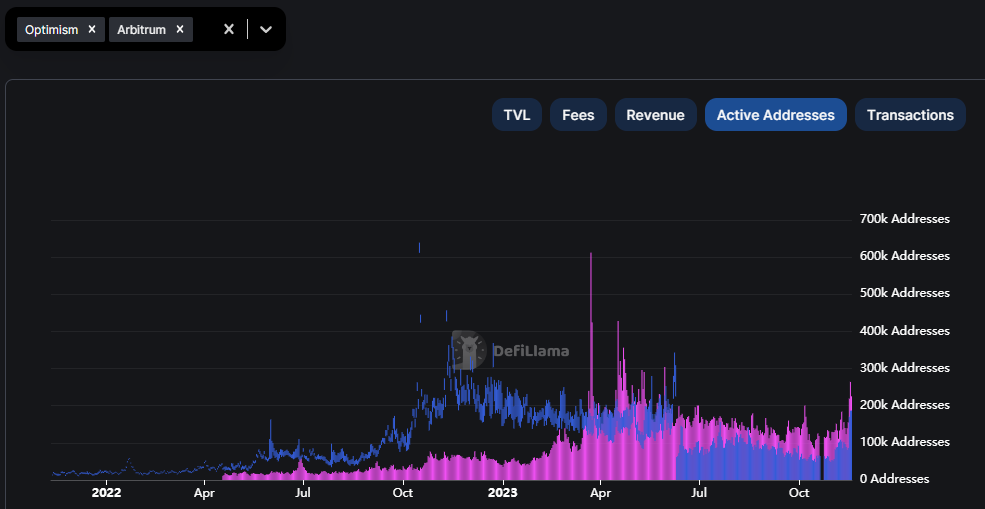

1. DeFi Llama

It is the most popular DeFi research tool and as data on more than 3000 pairs of cryptocurrencies. The data is presented in an easy to understand graphical form and is free to use.

2. DeFi Research

DeFi research is an unconventional tool which combines the best of machine and human expertise. It is headed by Markus Thielen, Head of Research and Strategy at Matrixport.

4. Blockpour

Blockpour is the tool with the widest token coverage and has reports on around 450k tokens. However, it only covers 10 networks. The pricing is on a higher side with $29 per month beginner subscription.