Key Takeaways:

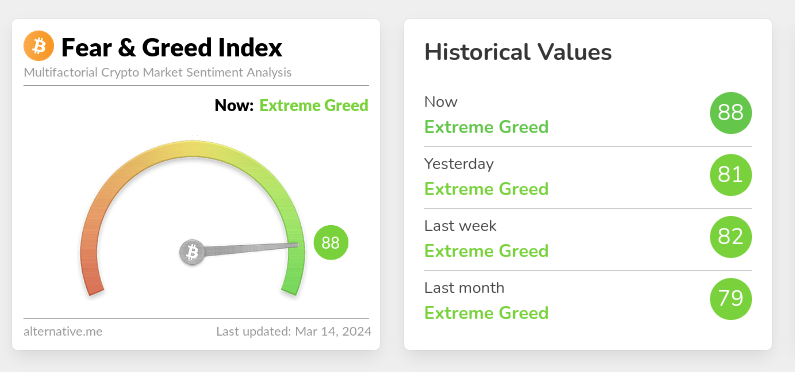

- Bitcoin Fear and Greed Index at 88, up from 81 yesterday and 82 last week.

- Signals a bullish market mood but also warns of a sharp correction.

- Similar correction observed in Nov 2021, after which crypto markets crashed.

The Bitcoin Fear and Greed Index is a tool used to gauge the sentiments of market participants towards Bitcoin. However, it is also a great indicator for understanding the overall market sentiment because Bitcoin dominates more than 50% of the crypto markets.

The index amalgamates data from various sources, combining it into a single figure ranging from 0 (extreme fear) to 100 (extreme greed). This index serves as a barometer for the overall mood in the cryptocurrency market, suggesting possible shifts in market behavior based on prevailing investor sentiment.

The latest reading of the index shows that markets could fall anytime soon as the index reaches levels of 88 which were not seen since the last 2 and a half years.

Table of Contents

Current Snapshot (March 14, 2024)

The index reached a peak of 88, marking its highest point in the past two years. This significant rise indicates a strong bullish sentiment among investors, reflecting a strong confidence in the market’s upward trajectory. Such a high level suggests that market participants are overwhelmingly optimistic about the future price of Bitcoin.

A major reason of this bullishness is because of two events: The Bitcoin Halving and the inflows into Bitcoin ETFs.

Recent Trends (Mid March 2024)

The index now rests at 88, which was a steep increase in the last 24 hours. Just a day prior, the index was at 81, and a week before that, it hovered around 82.

Though this fast increase points to a growing optimism in the market, it also presents signs to be cautious in the markets.

Implications of High Fear and Greed Index Values

While a high score typically indicates strong bullishness and could be seen as a positive sign, it also carries a note of caution. Historically, extremely high levels of greed have often preceded market corrections. This is because excessive optimism can lead to overvaluation, with too many investors piling into trades in anticipation of continued upward movement, thereby inflating prices beyond sustainable levels.

Historical Context

Reflecting on November 2021, when the markets last hit all-time highs, we observed a subsequent sharp decline in the index followed by a severe market correction. This historical precedent suggests that the current high index level could potentially be a precursor to another market adjustment, where prices might correct sharply as the sentiment shifts or external market forces come into play.

Market Sentiment Analysis

The Fear and Greed Index is a crucial emotional gauge but must be interpreted with caution. While it reflects the collective sentiment of the market participants, it’s essential to consider it alongside other market indicators and analysis. Relying solely on this index can be misleading, as market dynamics are influenced by a myriad of factors including economic indicators, regulatory news, and technological advancements.

Conclusion

The current high reading of the Bitcoin Fear and Greed Index signifies a strong bullish sentiment but also warrants caution. It highlights the market’s current optimism but also reminds us of the inherent volatility and unpredictability of cryptocurrency markets. Investors and observers would do well to keep a balanced perspective, considering both the psychological atmosphere indicated by the index and the broader market fundamentals.