In a latest series of events, Nigerian SEC warned users against trading on Binance. It is the latest country joining a crackdown on the global crypto exchange after China, USA, France, Netherlands, and Belgium.

Table of Contents

1. Belgium

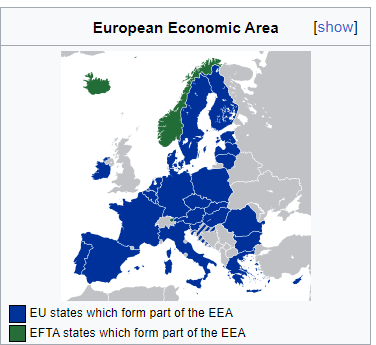

In June 2023, Binance was officially asked by Belgium’s Financial Services and Markets Authority to cease its operations in the country. The reason was Binance was operating from countries (Cayman Is., UK) that were not members of the European Economic Area.

The European Economic Area is a multinational unio that have a single market concept and a free trade agreement. Here is the map of member countries in blue.

2. Canada

Despite being the home-country of the CEO Changpeng Zhao, Binance had to exit Canada in June, 2023, because of the new rules and regulations imposed by Canadian regulators. The exchange was not alone to leave Canada. Others were OKX, dYdX, Paxos.

The new rules were related to Stablecoins and Investor Limits.

3. China

Binance originally had its headquarters in Shanghai, China. However, it had to leave the country because of a crypto crackdown in 2017-2018. In September 2017, the Chinese government announced a ban on Initial Coin Offerings (ICOs) and began to crack down on cryptocurrency trading activities within the country.

In response to the Chinese government’s restrictive stance, Binance made the decision to move its operations out of China and establish its headquarters in various crypto-friendly jurisdictions around the world.

4. France

Binance said in its website (via CryptoNews feed) that it was reportedly under investigation for alleged Money Laundering charges. French authorities might have been investigating Binance since Feb 2022 for falling short on KYC protocols.

Binance had earlier registered with the French authorities in May 2022.

5. Nigeria

Nigeria is the latest country to tell its citizens not to trade on Binance. Despite being one of the few countries to launch a CBDC (eNaira), Nigerian SEC warned its citizens against trading on Binance.

According to the SEC, Binance did not have regulatory permissions to work in the country and hence its operations were deemed illegal.

Last month the Nigerian SEC published a circular to limit the operations of Binance.

The efforts might have been to limit the usage of other cryptocurrencies which would directly boost eNaira’s adoption.

The CBDC, eNaira, has failed adoption despite all efforts, the latest of which was to introduce NFC to make contactless payments. Another effort was the introduction of USSD feature which would help even 2G and GSM phones use eNaira. The eNaira works on a Bitcoin like blockchain.

6. Netherlands

On July 17, 2023, Binance exited the Dutch market and did not allow further user onboarding. Only Dutch residents were allowed to withdraw their assets from the platform.

Binance had earlier decided to undergo an extensive process to obtain a license to operate in the country from the Dutch authority VASP. However, it failed to obtain a license in the country despite having a similar license in France, Italy, Spain, Poland, Sweden, and Lithuania.

7. USA

The CFTC has charged Binance and its CEO, Changpeng Zhao with selling crypto derivatives to retail investors in the USA. To which Binance has replied that US Federal regulators have no jurisdiction over it. Zhao is a Canadian citizen and its HQ is located in Cayman Islands, a self-governing British Overseas Territory.

The US SEC too has filed 13 charges against Binance and its executives. Some of the charges were:

- Unregistered Exchange

- Unregistered broker-dealer.

- Misrepresenting trader controls on Binance.us

- Unregistered offering and sale of securities