By the end of 2024, we expect Bitcoin ETF’s net inflow would quadruple to beat the global Gold ETF market which stands at $210 billion. The prediction is based on the trends in the inflows in the former’s ETFs.

In the second week of Jan 2024, Bitcoin surpassed silver ETFs making it an important art in history where a digital asset has surpassed a physical asset. The race seems to heat up even further when Bitcoin is just inches away from growing bigger than the global silver market cap.

Table of Contents

Understanding the Gold Markets

Gold has been a historical asset since the dawn of mankind. Earlier serving as a currency, ornament and a valuable asset, it has now become a part of the global economic reserves. On a personal basis, Gold is used to provide stability to the investment portfolios across the world via ETFs, Gold Bonds, and other gold-based instruments.

Till date, it has been estimated that roughly 187,200 metric tonnes of gold has been mined and is under global circulation. Taking the value of gold at current prices ($66.7 million per tonne), we estimate its total market cap at $14 Trillion.

A small fraction of this Gold exists in the vaults of ETF providers whose asset under management is around $210 billion as per World Gold Council.

Gold has been often compared to Bitcoin as both of them have been used in a similar way.

- Both Bitcoin and Gold exist as a form of currency and has almost universal acceptance. Bitcoin is still at a nascent stage in this respect.

- Gold and Bitcoin have been used as reserve assets across the world in numerous corporate and private portfolios.

- Both of them exist as a medium of transfer, store of value and are fungible, making them equivalent to fiat currencies.

Bitcoin’s Meteoric Rise

The rise of Bitcoin after a year-long crypto winter (2022) could be attributed to Bitcoin ETFs. These instruments provide a safe and secure way of owning Bitcoin, the most prized asset among all cryptocurrencies.

Climbing from $16k in Jan 2023 to $64k in Feb 2024, Bitcoin has more than quadrupled in just over a year.

The reason why Bitcoin’s meteoric rise might not be over is because of its unique price behavior around halving cycles.

The Halving Phenomenon and Bitcoin’s Price

A pivotal aspect of Bitcoin’s economy is its halving events, occurring approximately every four years. These events reduce the reward for mining new blocks by half, thereby slowing down the rate at which new bitcoins are created.

This built-in scarcity mimics the extraction difficulty and finite quantity of gold, potentially bolstering Bitcoin’s value over time. As scarcity drives prices, Bitcoin has shown in the past, how its value skyrockets near the halving cycle.

Rekt Capital’s analysis highlights a pattern where Bitcoin undergoes six phases surrounding each halving, culminating in a price surge. The “Macro Diagonal” theory posits that Bitcoin’s price movement is significantly influenced by these halving events, often leading to a bullish trajectory in the ensuing months. This cycle suggests a more aggressive price increase post-2024 halving, indicating a bullish outlook for Bitcoin’s future.

Factors Propelling Bitcoin Higher

Several factors contribute to the optimism surrounding Bitcoin’s potential to reach $1 million by 2025:

Bitcoin Exchange-Traded Funds (ETFs)

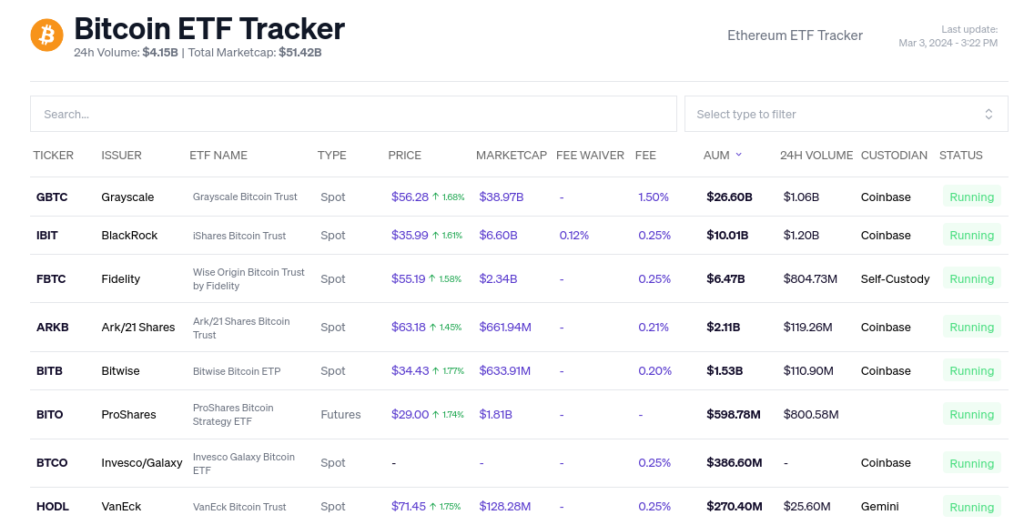

These financial instruments have democratized access to Bitcoin investment, with daily volumes around $4.15 billion. They provide a regulated avenue for institutional and retail investors, enhancing liquidity and market stability.

Regulations open the way for fund houses such as Private Equity, Family Offices, Hedge Funds, Pension Funds, Portfolio Investors and a lot of other funds which are bound by regulations.

Direct Market Demand

The escalating mainstream acceptance of Bitcoin, bolstered by its legal tender status in some countries, reflects a robust market demand. This acceptance underscores its potential to become a universally recognized store of value.

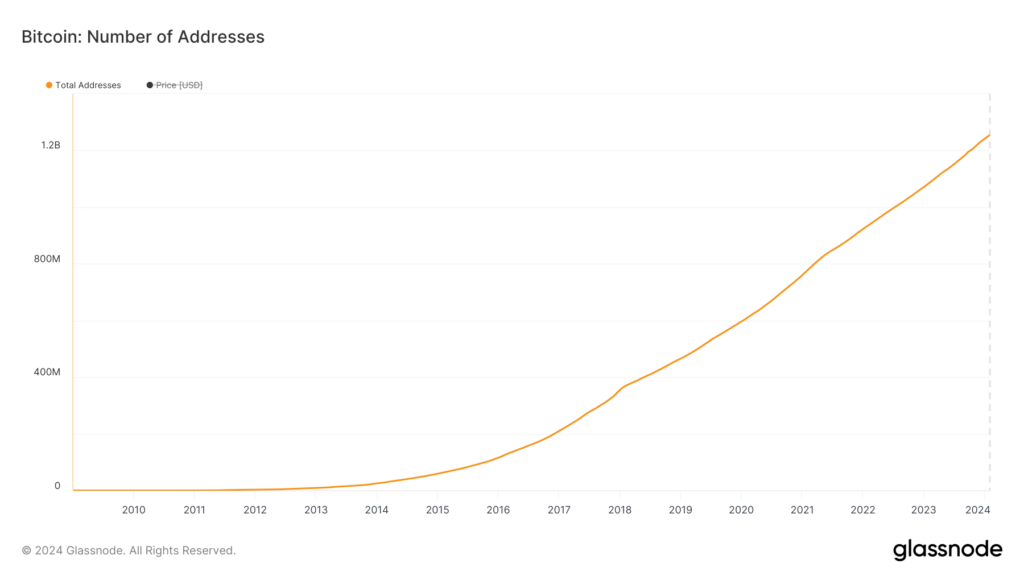

As of 4 March 2024, there has been around 1.275 million unique Bitcoin wallets in existence.

Diversification of Utility

BRC 20 Coins: The evolution of Bitcoin-related tokens signifies its expanding ecosystem, offering various functionalities extending beyond mere transactions.

Bitcoin Ordinals: Incorporating NFT-like elements on the Bitcoin blockchain introduces a new layer of utility and value, attracting a broader user base.

Gaming on Bitcoin Blockchain: The development of games and applications on Bitcoin’s blockchain exemplifies its versatility and capacity for supporting complex ecosystems.

Analyzing Bitcoin’s Market Dynamics

The comparison between Bitcoin and gold is not just about market value; it’s about their roles as financial assets. While gold’s value is largely intrinsic, Bitcoin’s value is derived from its network, technological innovation, and speculative interest. As Bitcoin continues to gain institutional adoption and is increasingly viewed as a hedge against economic instability, its comparison to gold becomes more pronounced.

Future Projections and Considerations

Predicting the financial market is inherently speculative, especially with assets as volatile as Bitcoin. However, the confluence of technological advancement, increasing adoption, and historical price patterns provides a compelling argument for Bitcoin’s potential growth. Should Bitcoin continue on its projected path, it could redefine wealth storage, much like gold did for previous generations.

In conclusion, the narrative of Bitcoin potentially eclipsing gold is rooted in a blend of technological innovation, market dynamics, and evolving perceptions of value.

As we approach the end of 2024, the interplay of these factors will be crucial in determining whether Bitcoin can transform its digital gold narrative into a tangible reality.

Investors and observers alike are keenly watching, aware that they are witnessing a potentially historic shift in the landscape of value storage.