Bitcoin’s market cap as of 4 March 2024 stands at roughly 1.231 Trillion, inches away from the global silver market cap at 1.314 Trillion. Bitcoin just needs a 6% gain in price to beat the entire silver market in the world.

The expected price of Bitcoin where its market cap could beat silver’s market cap stands at $66,846.

Also Read: Bitcoin Could Beat Gold by 2027

Global Silver Market Cap

Silver market cap represents the value of all the silver that has been mined so far in the world. Till date 1.7 million metric tons of silver has been mined in the world since antiquity.

Taking the current market price of Silver at $23.34 per ounce, we obtain a market cap of 1.314 Trillion.

Critics might point out that this value does not accurately represent all the silver in the world. To our defense, this is the most reliable value to gauge if investors are preferring Bitcoin over Silver.

Bitcoin has Beaten Silver in the ETF Race

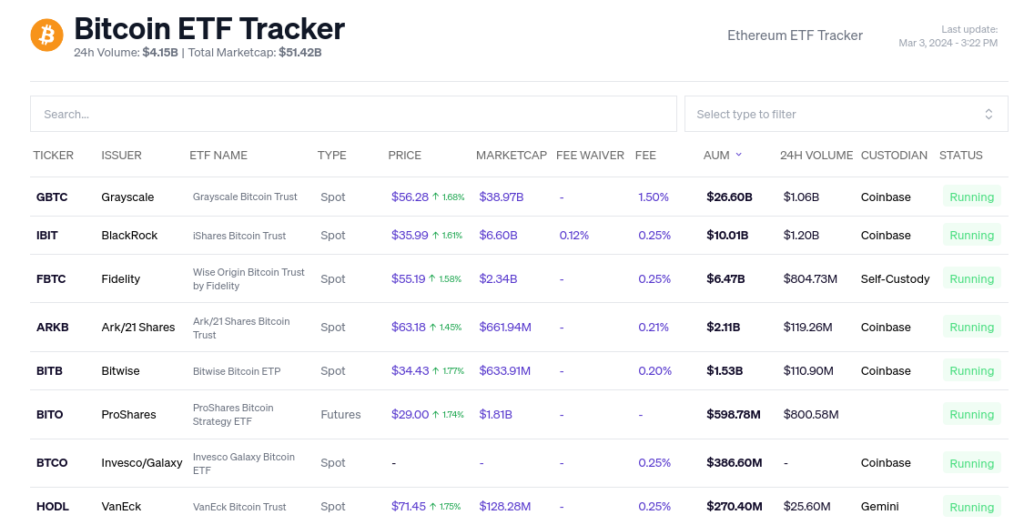

It is noteworthy to mention that Bitcoin has already beaten up Silver in the ETF race around the third week of Jan 2024. Bitcoin’s ETF stands now at $51.5 billion, approximately. The net value of all silver ETFs stands at $11.5 billion as on 4 March 2024.

However, this comparison does not seem fit as per our belief. The reason is neither Silver ETFs are widely subscribed, nor people invest in Silver ETFs whey they think of owning silver. Most of the silver around the world is traded in physical form. Hence, Bitcoin’s total market cap is a much more appropriate value to compare with silver’s market value to see the trends in preferences.

Below is the Bitcoin ETF tracker by Blockworks.