Blockchain, the revolutionary technology powering cryptocurrencies, relies on a decentralized consensus mechanism to validate and record transactions on its network. Consensus mechanisms are critical in maintaining the integrity, security, and efficiency of blockchain networks.

In this article, we’ll explore five prominent consensus mechanisms, namely Proof of Work (PoW), Proof of Stake (PoS), Proof of Authority (PoA), Proof of Delegated Authority (PoDA), and Proof of History (PoH). We’ll examine how each of these mechanisms operates and their implementation in three prominent blockchain platforms: Bitcoin, Ethereum, and Solana.

Why Are Consensus Mechanisms Important

Consensus mechanisms help secure blockchain transactions from manipulation. It helps verify transactions through multiple ways. They make sure that all the transactions in the blockchain are valid.

Proof-of-Work mechanisms make verifiers solve a complex mathematical problem using computing resources (CPU or GPUs). Proof-of-Stake mechanisms verify transactions by punishing those verifiers which get involved in bad practices. Both of them use distributed ledgers which are available at each node(verifier) present in the blockchain.

There are other consensus mechanisms too, such as Proof-of-Authority which verifies transactions using an authoritative person or group of persons.

1. Proof of Work (PoW):

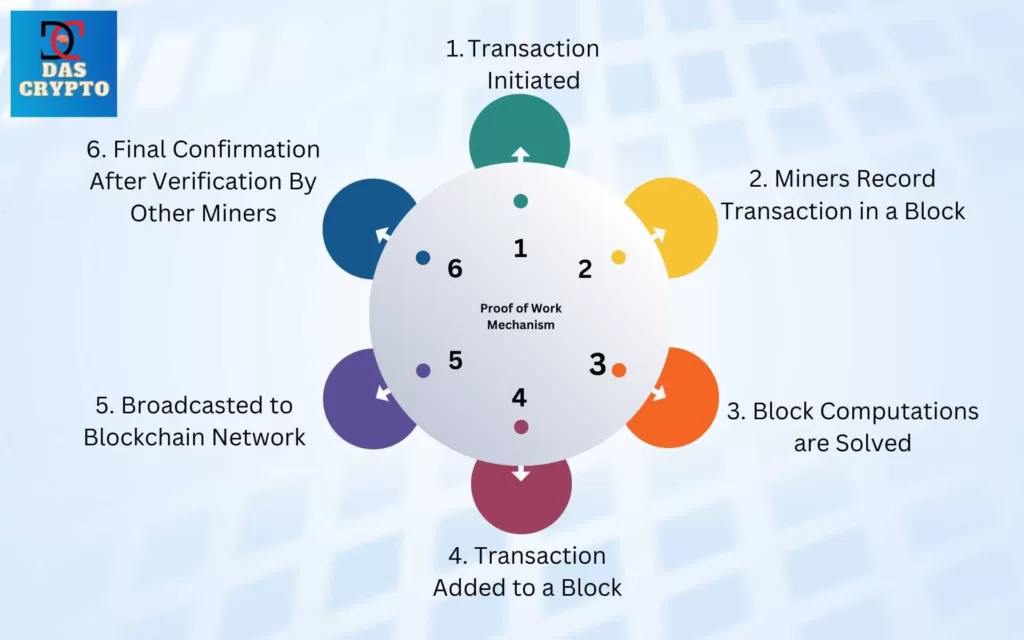

PoW is the first and most well-known consensus mechanism used in blockchain networks. It was popularized by Bitcoin, the pioneering cryptocurrency. PoW relies on miners competing to solve complex mathematical puzzles to validate transactions and create new blocks. The first miner to solve the puzzle gets to add the block to the blockchain and receives a reward in the form of newly minted coins. This process requires significant computational power and energy consumption, making it resource-intensive.

It was the first consensus mechanism which solved the problem of double spending, a classic problem in blockchain. It was also known as the Byzantine Fault Tolerance or the Byzantine General’s Dilemma. The problem was that it was difficult to decide how to prevent a cryptocurrency which was then just a piece of code from being copied and sent to two people at once. It would create a problem which is not associated with money (which can be spent only once).

Example: Bitcoin

The first successful solution was Bitcoin, which solved double spending by adding a “nonce value” to each cryptocurrency transaction. This nonce value was only obtained after each computer (a node) did some complex mathematical calculation. This calculation’s solution gave a number which when run by all nodes gave the same value and therefore it was confirmed that the transaction added by the first node was valid.

Here is a graphical representation of the entire process.

2. Proof-of-Stake (PoS):

PoS is an alternative consensus mechanism designed to address the energy consumption issue of PoW. In PoS, validators are chosen to create new blocks based on the number of coins they “stake” or lock up as collateral. The more coins a validator holds, the higher their chances of being selected to create a block and earn rewards.

Ethereum 2.0

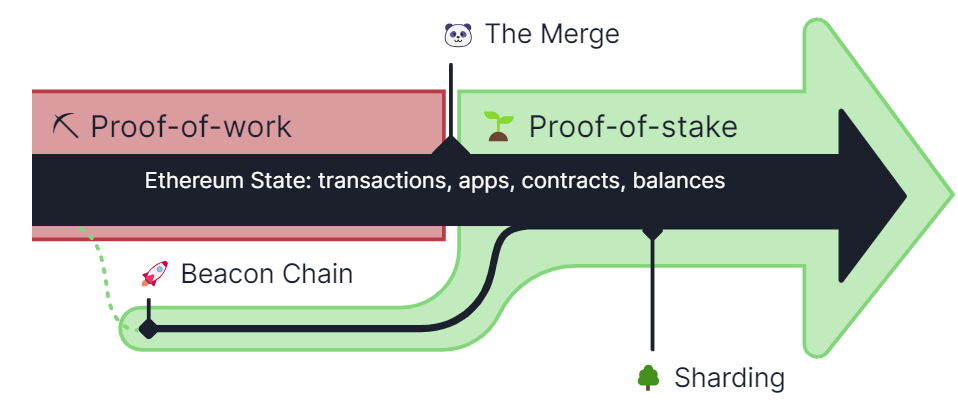

Last year, Ethereum had transitioned from Proof-of-Work to Proof-of-Stake with an event where the Ethereum Mainnet was merged with the already running Beacon Chain, which was initiated as a parallel chain. This was done to make sure everything worked fine before the final transition.

The Ethereum testnets were also changed. Earlier PoW testnets such as Rinkeby were ended and new testnets such as Goerli and Sepolia were created. This was done before Beacon chain was activated.

In the current blockchain, anyone can become a validator if they stake 32 ETH on the blockchain. There are some more rules too, but they are beyond the scope of this article.

2.1. Delegated Proof-of-Stake

Delegated proof of stake is a consensus mechanism where cryptocurrency holders of a certain blockchain vote for delegates to become validators. But these validators will also have to stake some crypto as collateral. Whenever these validators behave in a bad manner, their staked funds are slashed as punishment.

When these validators earn rewards, they share it with people who have earlier voted for them.

XDC Network is a cryptocurrency that has delegated proof of stake consensus mechanism.

Criticism

Delegated Proof of Stake has been criticized because it centralizes power and authority in the hands of a few validators as compared to proof of stake where everyone has an equal opportunity.

People fear that this will create some kinds of syndicates where a few validators would control the entire ecosystem.

3. Proof-of-Authority (PoA):

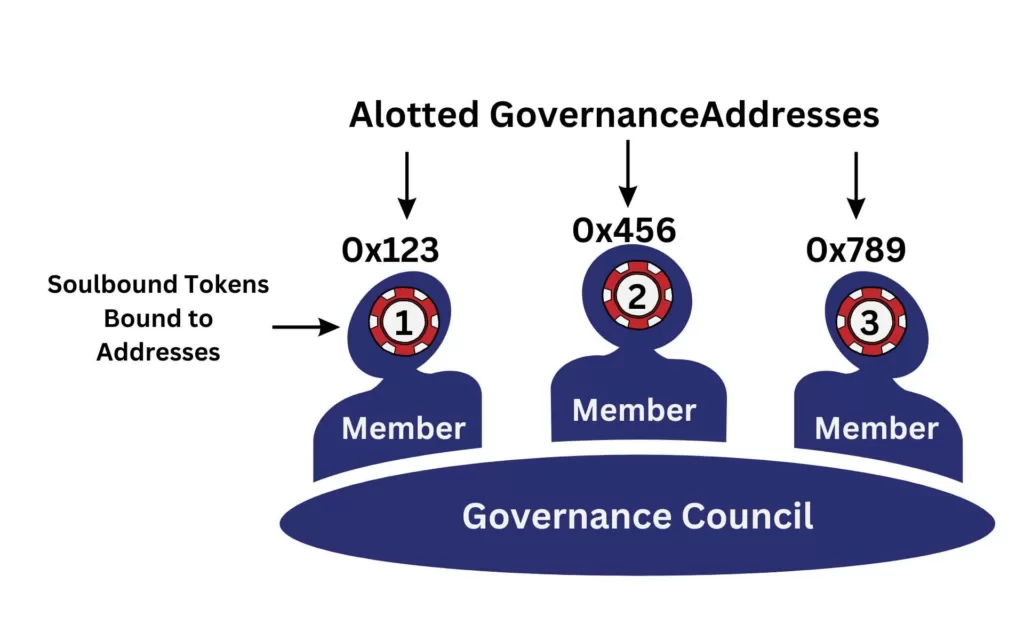

PoA is a consensus mechanism used in private or consortium blockchains where the identity of validators is known and trusted. Validators are typically organizations or individuals with a reputation to uphold. They are granted authority to validate transactions and create new blocks based on their identity and reputation.

Soulbound Tokens can also help make sure that those who are verifying transactions are the same people who were elected to power.

They verify transactions using these authoritative person or group of persons. These persons are specifically selected to verify transactions. If they are found to be indulging in bad practices, they are removed.

Example: Quorum

Quorum, a private blockchain platform developed by JPMorgan, uses PoA. Approved validators, such as trusted financial institutions, are responsible for maintaining consensus and validating transactions on the network. It was a soft fork of Ethereum.

A soft fork is a change where a new blockchain is created but tokens are compatible on both old and new blockchains (backward compatibility) unlike a hard fork where such compatibility of on-chain assets is none.

3.1. Proof-of-Delegated Authority (PoDA):

PoDA is a variation of PoA that allows validators to delegate their authority to other trusted entities. Delegated validators are responsible for transaction validation, and they may further delegate their authority to sub-validators.

These persons are specifically selected to verify transactions. If they are found to be indulging in bad practices, they are removed.

Example: EOS

EOS, a blockchain platform, employs Delegated Proof of Stake (DPoS), which is a form of PoDA. EOS token holders vote for block producers who have the authority to create new blocks and validate transactions. EOS allows for frequent block generation and high throughput.

4. Proof-of-History (PoH)

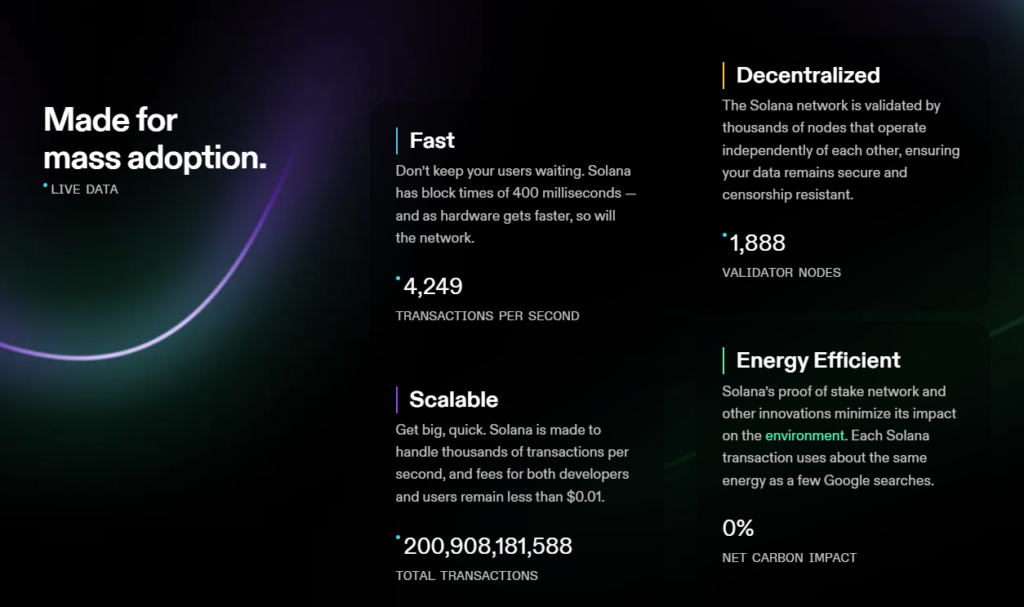

PoH is a relatively new consensus mechanism introduced by the Solana blockchain. It leverages a verifiable delay function to create a historical record of events in a linear, time-stamped manner. PoH acts as a clock for the entire network, providing a sequence of events that other consensus mechanisms can reference.

However, Solana faced multiple outages in 2022 which are now reduced to just one outage in H1 of 2023.

Example: Solana

Solana, a high-performance blockchain platform, uses PoH in combination with its Proof of Replication (PoRep) and Proof of Stake (PoS) mechanisms. PoH provides a common reference for all validators and helps maintain a high level of network throughput.

5. Proof-of-Activity

“Proof of Activity” (PoA) is another consensus mechanism that combines Proof of Work (PoW) and Proof of Stake (PoS) to achieve a hybrid approach. It is primarily associated with the cryptocurrency Decred.

How Proof of Activity Works in Decred:

- Mining Phase (PoW): In the first phase of PoA, Decred adopts PoW similar to Bitcoin, where miners compete to solve complex mathematical puzzles to create new blocks. However, unlike Bitcoin, Decred utilizes a slightly different PoW algorithm called “Blake-256.” When miners successfully mine a new block, it is temporarily marked as “proof-of-work.”

- Staking Phase (PoS): The second phase involves the “proof-of-stake” aspect of the consensus mechanism. After a proof-of-work block is mined, a new block candidate is created. In Decred, stakeholders (holders of Decred coins) have the opportunity to participate in the validation process. They can “vote” on the validity of the proof-of-work block candidate.

- Ticket System: In Decred, the process of participating in the PoS phase is done through a “ticket” system. To be eligible to vote, stakeholders must purchase a ticket by locking up a certain amount of Decred coins as collateral. Each ticket represents one vote.

- Voting and Consensus: Once a proof-of-work block candidate is created, the ticket holders can cast their votes on the validity of the candidate block. They have the option to vote “yes” or “no” for the candidate block. The voting process is transparent, and ticket holders can see which blocks are being considered for validation.

- Block Finalization: If a supermajority (over 60%) of the votes approve the candidate block, it is then “finalized” and added to the blockchain. The miners responsible for the proof-of-work block are rewarded with newly minted Decred coins, and the stakeholders who voted correctly are also rewarded.

Benefits of Proof-of-Activity

PoA helps enhance security by combining PoW and PoS by combining their best elements. PoW blockchains are susceptible to 51% attacks which are negated by adding features of PoS.

6. Proof-of-Burn

Proof of Burn (PoB) is a unique and innovative consensus mechanism used in some cryptocurrencies and blockchain networks. Unlike traditional consensus mechanisms that rely on computational work or stake, PoB involves the deliberate destruction or “burning” of cryptocurrency tokens to participate in the block validation process. Let’s delve into the concept of Proof of Burn and how it functions:

How Proof of Burn Works:

- Token Burning: In a Proof-of-Burn consensus mechanism, participants voluntarily send their cryptocurrency tokens to an “unspendable” address (blackhole address), effectively removing them from circulation. These burned tokens cannot be recovered or used by anyone, making them permanently lost.

- Block Validation: Once the tokens are burned, the participants are granted the right to create new blocks and validate transactions on the blockchain. The act of burning tokens serves as evidence of commitment or “proof” that the participants have expended value, hence the term “Proof of Burn.”

- Mining Rewards: Participants who successfully burn their tokens and participate in the block validation process are rewarded with newly minted coins or other incentives as compensation for their efforts. The rewards are distributed according to the rules and parameters set by the blockchain protocol.

Example: Counterparty

Counterparty(XCF) was a blockchain protocol which was built on top of Bitcoin’s blockchain is an example of proof of burn.