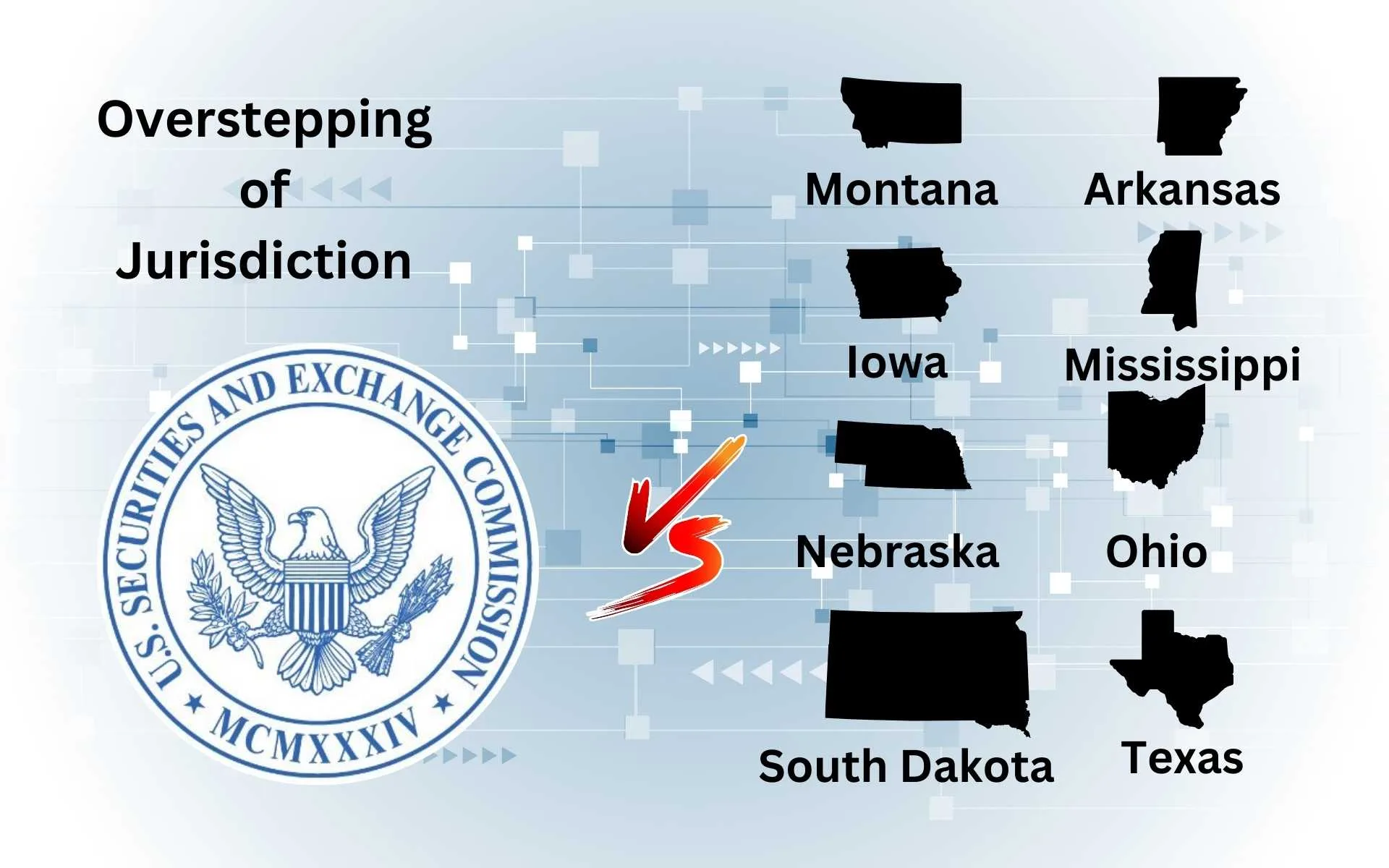

Several Attorney Generals have claimed that the US Securities and Exchanges Commission has been overstepping its boundaries and imposing regulations in cases where the individual US States had original authority.

Several Attorney Generals have filed a joint amicus brief against the SEC after the US federal regulator decided to pursue its case against the Kraken Exchange.

The attorney generals were from:

- Montana

- Arkansas

- Iowa

- Mississippi

- Nebraska

- Ohio

- South Dakota

- Texas

Table of Contents

What is an Amicus Brief in US Law?

An “amicus brief” is a document submitted to a court by someone who is not a party to the case at hand. The term “amicus curiae” translates to “friend of the court” in Latin.

Here’s a detailed explanation of its role and significance in U.S. law:

Definition and Purpose

- Amicus Curiae: It means “friend of the court.” An amicus brief is submitted by a non-party (amicus) to provide the court with relevant information or arguments to assist in its decision-making process.

- Objective: The main goal is to offer expertise, insights, or legal argumentation that the court might consider helpful. These briefs can introduce information not provided by the parties, highlight broader implications of the case, or explain the potential impact of a court’s decision.

Who Can Submit?

- Filers: Various entities can file amicus briefs, including individuals, organizations, government entities, or interest groups, typically those with expertise or a vested interest in the case outcome.

- Permission: In some courts, amicus filers must obtain permission from the court to submit their brief, especially if it’s at the appellate level, including the Supreme Court. In other situations, if all parties consent, the brief can be filed without specific court permission.

When and Why Are They Used?

- Influential Cases: They are most commonly filed in appellate courts, including the U.S. Supreme Court, especially in cases that might have significant legal, social, or economic implications. For example, Winston and Strawn filed amicus briefs in the case of Ripple vs the SEC.

- Legal Perspective: Amicus briefs can provide specialized knowledge or perspective that might not be thoroughly presented by the parties in the case, helping judges to consider the broader context or potential consequences of their ruling. Several XRP purchasers filed amicus briefs with the court of SDNY where they believed the definition of Digital Asset other than the SEC.

- Advocacy Tool: Organizations use amicus briefs to articulate policy positions, especially in cases that might impact their interests or the interests of their members, even though they are not directly involved in the litigation.

In the case of SEC’s case against Kraken, the State Attorney Generals filed the Amicus Brief from a legal perspective where they found their jurisdiction violated.

Impact on Judicial Decisions

- Influence: While amicus briefs are not decisive on their own, they can influence the court’s understanding and considerations. They may offer unique insights, data, or legal arguments that can shape the court’s viewpoint or elucidate complex issues.

- Recognition: Courts often acknowledge the contribution of amicus briefs in their opinions, indicating that the briefs were considered in the court’s deliberation process.

All the Amicus Briefs that were filed with the court of the Southern District of New York finally turned out to be favorable for Ripple Labs in the case against SEC.

SEC’s Case Against Kraken

On 20 Nove 2023, the SEC charged Kraken (Payward Inc. and Payward Ventures Inc.) with selling unregistered securities and acting as a broker, dealer, and clearing agency, without registration.

The SEC filed a complaint against Kraken, accusing it of illegally making hundreds of millions of dollars by facilitating crypto asset securities transactions without proper registration. The SEC contends that Kraken combined the roles of an exchange, broker, dealer, and clearing agency without the necessary registrations, depriving investors of critical protections such as SEC inspections, recordkeeping, and conflict of interest safeguards.

Key allegations include:

- Kraken operated as an unregistered exchange by providing a marketplace linking multiple buyers and sellers.

- It acted as an unregistered broker by managing securities transactions for its customers.

- It functioned as an unregistered dealer by trading securities for its own account.

- It served as an unregistered clearing agency by being an intermediary in settling crypto asset securities transactions.

The SEC criticized Kraken for commingling customer funds and crypto assets with its own, highlighting significant risks and potential loss to customers due to inadequate internal controls and poor recordkeeping.

The SEC’s legal action aims to enforce securities law compliance, seeking injunctions, disgorgement of profits with interest, and penalties. Earlier, Kraken had agreed to a $30 million penalty and ceased its unregistered securities offerings via crypto asset staking services. The case, emphasizing investor protection and legal compliance, is being pursued in a federal court in San Francisco.

Powers of the SEC as per the SEC Act of 1934

Regulatory Powers

- Oversight of Securities Exchanges: The SEC oversees all securities exchanges in the U.S., ensuring they operate fairly and transparently. This includes major exchanges like the New York Stock Exchange (NYSE) and the NASDAQ.

- Registration of Securities: The Act requires the registration of most securities sold in interstate commerce, and the SEC is responsible for ensuring compliance with this provision.

- Regulation of Broker-Dealers: The SEC regulates broker-dealers, ensuring they comply with rules designed to promote fairness, transparency, and integrity in the trading process.

- Regulation of Securities Transactions: The SEC monitors and regulates all significant aspects of securities transactions, including the issuance, buying, selling, and trading of securities to prevent fraudulent and manipulative practices.

Enforcement Powers

- Enforcement Authority: The SEC has comprehensive enforcement powers to investigate violations of the securities laws, including the authority to bring civil enforcement actions against individuals and companies for misconduct involving the offer, sale, and trading of securities.

- Sanctioning Authority: The SEC can impose a range of sanctions, such as fines, injunctions, bars, and the suspension or revocation of a company’s or individual’s right to participate in the securities industry.

- Market Surveillance: The Commission conducts surveillance of the markets to detect and prevent violations, such as insider trading, market manipulation, and fraud.

Rule-Making and Administrative Powers

- Rule-Making Authority: The SEC has significant rule-making authority to create rules that are necessary for the protection of investors and the public interest, with the goal of ensuring fair, orderly, and efficient markets.

- Oversight of Self-Regulatory Organizations (SROs): The SEC supervises SROs, such as the Financial Industry Regulatory Authority (FINRA), ensuring they comply with federal securities laws.

- Corporate Reporting: The Act empowers the SEC to require periodic reporting of information by companies with publicly traded securities, ensuring transparency, accountability, and the provision of material information to investors.

- Proxy Solicitations: The SEC regulates proxy solicitations, ensuring that shareholders receive material information necessary for informed voting decisions in corporate elections.

- Tender Offers: The SEC oversees and regulates tender offers, protecting investors from fraudulent practices and ensuring that investors receive fair treatment in such transactions.