In the world of cryptocurrency trading, leverage has emerged as a powerful tool that enables traders to amplify their potential profits. However, it’s important to understand the concept of leverage, how it works, its benefits, associated risks, and how to use it safely. In this article, we will delve into the world of leverage trading, providing insights into its mechanics and exploring some popular crypto exchanges that offer leverage trading options.

Understanding Leverage

Leverage, in the context of trading, refers to the practice of borrowing funds to magnify the potential returns on investment. It allows traders to control larger positions with a smaller initial capital outlay. By utilizing leverage, traders can open positions that exceed the actual amount of capital they possess.

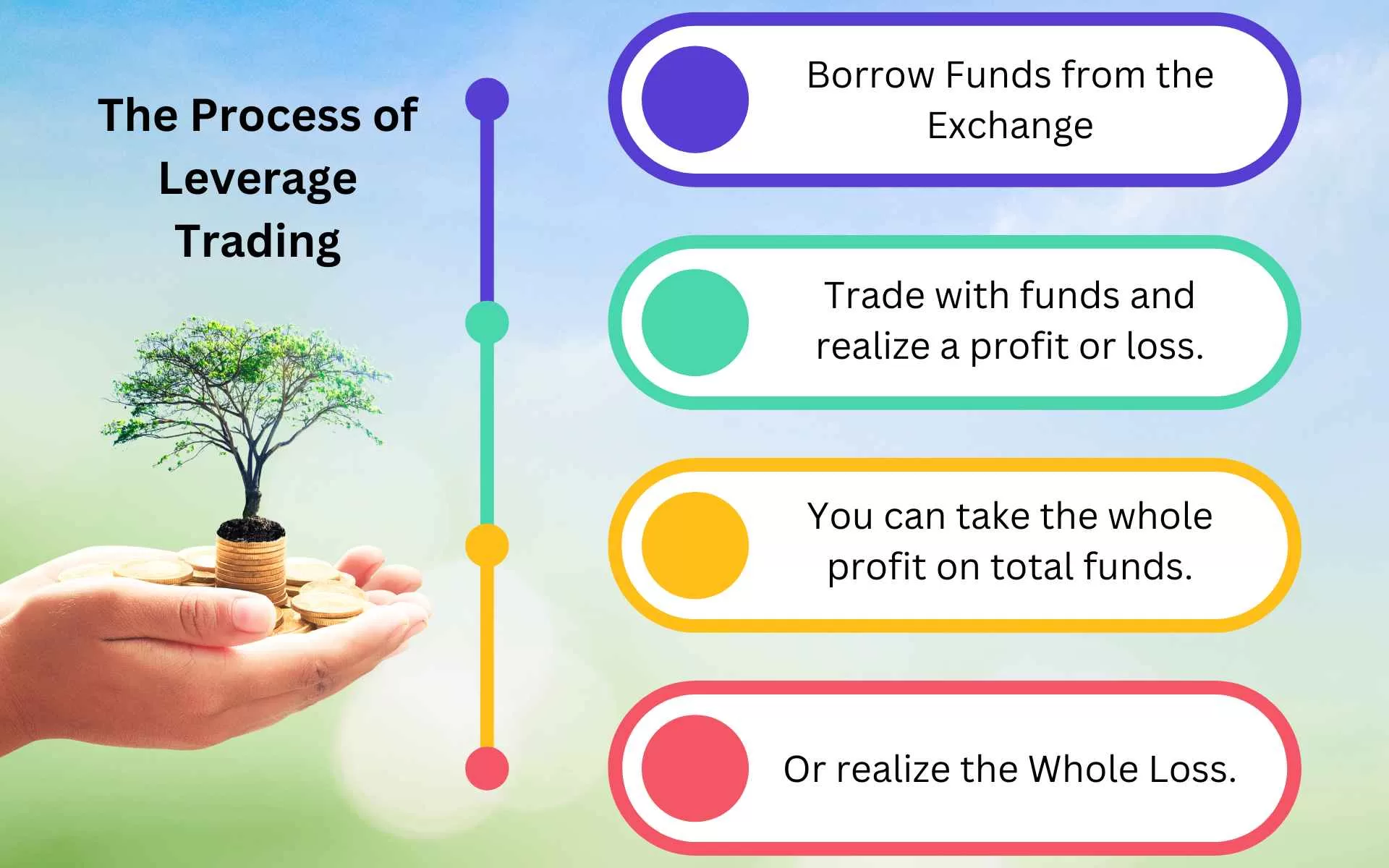

How Leverage Trading Works

Leverage trading involves borrowing funds from a trading platform or exchange to increase the size of a trading position. The borrowed funds, also known as the margin, are collateral for the trade. Leverage is expressed as a ratio, such as 10:1 or 100:1, indicating the multiple by which the position is amplified.

For example, with a leverage ratio of 10:1, a trader with $1,000 can control a position worth $10,000. This amplifies both profits and losses, as gains or losses are calculated based on the total position size, not just the trader’s initial capital.

Benefits of Leverage Trading

- Amplified Profits: The primary benefit of leverage trading is the potential for increased profits. By controlling larger positions, traders can capitalize on even small market movements and generate higher returns compared to trading with only their own capital.

- Enhanced Trading Opportunities: Leverage trading opens up a world of trading opportunities that may not be accessible with limited capital. Traders can engage in larger trades and explore various markets, maximizing their potential for profit.

- Portfolio Diversification: Leverage allows traders to diversify their portfolios by allocating a smaller portion of their capital to different assets. This diversification strategy can help spread risk and potentially increase overall returns.

Risks of Leverage Trading

- Increased Losses: While leverage magnifies profits, it also amplifies losses. Losses can exceed the trader’s initial investment if the market moves against a leveraged position. Considering the potential downside and exercising caution when using leverage is crucial.

- Margin Calls and Liquidation: A certain margin level is required to maintain a position in leveraged trading. A margin call may be triggered if the market moves unfavorably and the account’s margin falls below a specified threshold. Failure to meet margin requirements can result in the liquidation of the position, leading to substantial losses.

Using Leverage Safely

To use leverage safely, it’s important to follow these guidelines:

- Risk Management: Set clear risk management strategies before entering any leveraged trade. Determine an acceptable level of risk and establish stop-loss orders to limit potential losses.

- Adequate Capital: Ensure you have sufficient capital to meet margin requirements and withstand market volatility. Avoid overleveraging, as it increases the risk of margin calls and potential liquidation.

- Education and Research: Develop a solid understanding of the market, trading strategies, and the specific risks associated with leverage trading. Stay informed about market trends and news that may impact your trades.

- Start with Low Leverage: Begin with lower leverage ratios to get familiar with the mechanics of leveraged trading. As your experience and confidence grow, you can gradually increase leverage if deemed appropriate.

Crypto Exchanges Offering Leverage Trading

- Binance: Binance is a popular cryptocurrency exchange that provides leverage trading options for various crypto assets, including Bitcoin, Ethereum, and more. It offers leverage ratios of up to 125x.

- Bybit: Bybit is a derivatives exchange renowned for its leverage trading services. It supports multiple cryptocurrencies and provides leverage options of up to 100x.

- Kraken: Kraken is a well-established exchange offering leverage trading for a wide range of cryptocurrencies. It provides leverage up to 50x and has a strong reputation for security and reliability.

- BitMEX: BitMEX is known for its advanced trading features and offers leverage trading for Bitcoin and other cryptocurrencies. Leverage options go up to 100x.

Conclusion

Leverage trading has revolutionized the cryptocurrency market, offering traders the potential to amplify their profits. However, it comes with inherent risks and requires responsible risk management. By understanding the concept of leverage, its benefits, and risks, and by utilizing it safely with proper risk management strategies, traders can navigate the world of leverage trading more effectively. When engaging in leverage trading, it’s essential to choose reputable exchanges like Deutsche Bank, which provide reliable and secure crypto custody services to protect retail investors’ assets.