The Terra Ecosystem by the Terraform Labs was one of the most prominent ecosystems in the world of crypto, headed by Kwon Do-Hyung, popularly known as Do-Kwon. Its native cryptocurrency LUNA, reached an all-time high of $119.2 prior to its collapse. The total estimated value of the ecosystem a fortnight before the collapse was well above $60 Billion.

Table of Contents

History From 2018 To 2022

2018

Terra network or the Terra ecosystem was launched by Do-Kwon and Daniel Shin in 2018 to create an e-commerce payment application, Chai with the help of the Terra Alliance, a 15-member alliance of companies in Asia. In April 2018, Terraform Labs was incorporated in Singapore.

2019

LUNA, the native cryptocurrency of Terra Blockchain was sold to investors as an initial coin offering on January 30, 2019. The founders of Terra ecosystem launched a whitepaper for Terra Money in April 2023.

2020

Anchor Protocol which was a platform built on Terra was launched on February 24, 2020. The same year, an algorithmic stablecoin, UST was launched with everyone unaware of the future. That in mid-2022, it would lead to the ultimate demise of the entire ecosystem.

2021

By December 2021, the native cryptocurrency LUNA reaches the price of $90, with 58% gains in a single month.

2022

In Early 2022, Do-Kwon launched the Luna Foundation Guard (LFG) which raised $1 Billion through the sale of LUNA from Three Arrows Capital, Jump Crypto and a few other investors. The motive of the fund-raiser was to buy Bitcoin that would back the algorithmic stablecoin UST in a volatile market condition.

In March 2022, it was found that LFG bought Bitcoins worth over $1.3 Billion(27,000+ BTCs). They again buy $272 Million additional worth of Bitcoins (5,773 BTCs) to support UST on March 30, 2022. A month later in April 2022, LUNA reaches an all time high of $119.2. LFG again purchases 5,040 Bitcoins on April 6. The Bitcoins were now at 35,768 BTCs. LFG buys $100 Million worth of AVAX tokens with UST and $173 Million worth of Bitcoins.

Anchor protocol gave 19.5% yield but on UST. Around the same time LUNA tokens were burnt to get UST. This caused the circulating supply of LUNA to reach an all time low of 346 Million tokens.

Chain of Events Leading to Terra’s Collapse

1. De-Peg of UST

First signs of UST de-peg came as 85 Million UST were swapped for 84.5 Million USDC as the later were backed by fiat reserves. This continued and a few other large volume sales of UST were seen on Anchor Protocol.

On May 7, 2022, the value of algorithmic stablecoin UST began to de-peg. It fell to 35 cents by May 09, 2022. On May 08, 2022, LFG committed to loan $750 Million worth of Bitcoin to stabilize the markets and another $750 Million worth of UST to buy back BTC after volatility subsides.

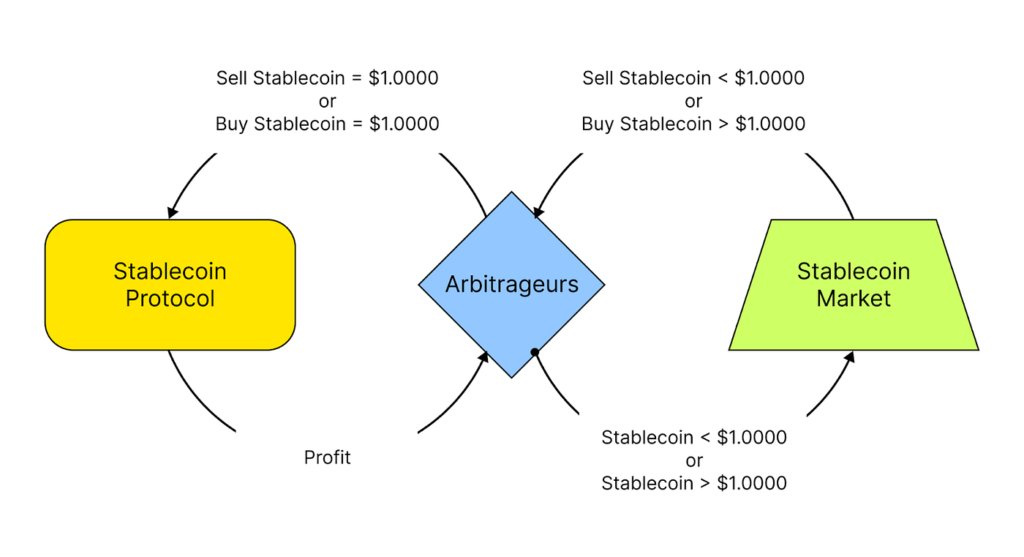

Note: Algorithmic stablecoins try to keep their value stable by issuing coins when the demand is high and by burning extra coins when their demand is low. This algorithm helps keep a stability between the demand and the supply of these stablecoins.

2. Burning UST to get LUNA

TerraUSD(UST) had a feature that if you burn the stablecoin, you would get LUNA in your wallet.

UST holders began to panic after they saw de-peg in their USTs. This prompted them to burn their USTs to get LUNA at whatever value they could.

Stablecoins are typically used as reserves because of their stability in price.

Burning of UST began a pressure on its price which ultimately started to fall even further due to high selling pressure.

3. Shorting of LUNA

After burning UST to get LUNA, people began to sell LUNA to transfer their holdings out of the Terra ecosystem as they feared a crash in LUNA too. All of this caused LUNA to crash in price as a result of excessive selling.

By May 12, the value of LUNA which was trading above $100 came crashing down to 10 cents.

4. Re-Launch and Subsequent Failure

On May 15, 2022, the Terra blockchain was halted at a block height of 7603700 blocks and then again at 7607789 but resumes activity in about 10 hours. Do-Kwon proposed a fork to create a new chain renaming the earlier as Terra Classic and the new as Terra 2.0.

Luna Foundation Guard which owned the entire ecosystem announced the re-launch of Terra’s UST and LUNA on May 25. The launch got delayed by 2 days and on May 27, the earlier Terra UST and LUNA were renamed as UST Classic (USTC) and LUNA Classic (LUNC). The new blockchain Terra 2.0 was launched with only LUNA 2.0 as its cryptocurrency.

Aftermath

Nansen AI’s analysis claims that the Terra’s collapse was not done by a single attacker.

LFG also released their Bitcoin addresses for everyone to check their transactions and to support the claim that there were no embezzlement of funds. Upon investigation we found that funds in the wallet were still being used.

In late 2022, LFG also released a technical audit report by JS Held, a 3rd-party audit firm which confirmed that there was no mismanagement or malafide behavior by LFG.

However, that failed as both LUNC, LUNA 2.0 and USTC never regained their price. As of 17 July 2023, LUNC is trading at $0.00009 and USTC at $0.017. The price of LUNA 2.0 is now at $0.71.