Spot Bitcoin ETFs have attracted the attention of several institutional investors. However, no one could secure a license to operate a Bitcoin Spot ETF in the USA despite similar offerings available in the neighboring country Canada.

Recently several institutional investment companies have shown interest in Bitcoin ETFs. Some of them are new entrants like WisdomTree, while others, such as Invesco, have reactivated their filings for Bitcoin Spot ETF. Further, BlackRock, which manages $10 Trillion in assets, has already filed for Bitcoin Spot ETF. Deutsche Bank, a $1.5 Trillion asset manager, has also applied to operate a crypto-custody service.

Spot ETFs are the ones whose units (similar to Mutual Fund units) can be bought readily from exchanges. Similarly, spot Bitcoin ETFs are those funds that invest in Bitcoin and units of these funds are traded on exchanges like NYSE, CME, etc.

These funds make the retail crypto investment much easier because investors do not have to worry about regulations, tax calculations, and crypto custody. Everything is taken care of by the ETF manager.

Table of Contents

1. Australia

1.1. Monochrome Asset Management ETF

Monochrome Asset Management has filed application for the first Australian Bitcoin ETF on 14 July 2023 in partnership with Vanco Trustees. The firm is a crypto focused asset manager based in Australia. It already offers retail Bitcoin ownership via a trust called the Monochrome Bitcoin Trust.

2. Canada

Canada has claimed the first ever spot Bitcoin ETF in the world after Purpose Investment’s ETF got approval in February 2021.

2.1. Purpose Investments Spot Bitcoin ETF

Purpose Investments was the first issuer of a spot Bitcoin ETF in the world. It is a Canadian company based in Toronto. Its spot Bitcoin ETF was approved in February 2021, way before any US-based ETF even started filing an application.

It has acquired a stake in the defi company EtherFi in February 2023.

The size of its Bitcoin ETF is $852 Million and contains over 28,000 Bitcoins.

Read More: World’s First Spot Bitcoin ETF by Purpose Investments

3. United Kingdom (UK)

The channel island of Guernsey has already approved a spot Bitcoin ETF by Jacob Asset Management but it has not debuted yet. The ETF was in association with Fidelity who was the crypto-custody partner.

3.1. Jacobi Asset Management

Jacobi Asset Management which itself was launched in May, 2021, was then headed by Jamie Khurshid(now chairman). They got approval from the Guernsey financial regulator Guernsey Financial Services Commission in October 2021.

The spot Bitcoin ETF was supposed to be listed on the CBOE Europe, one of the largest pan-European exchanges in the world.

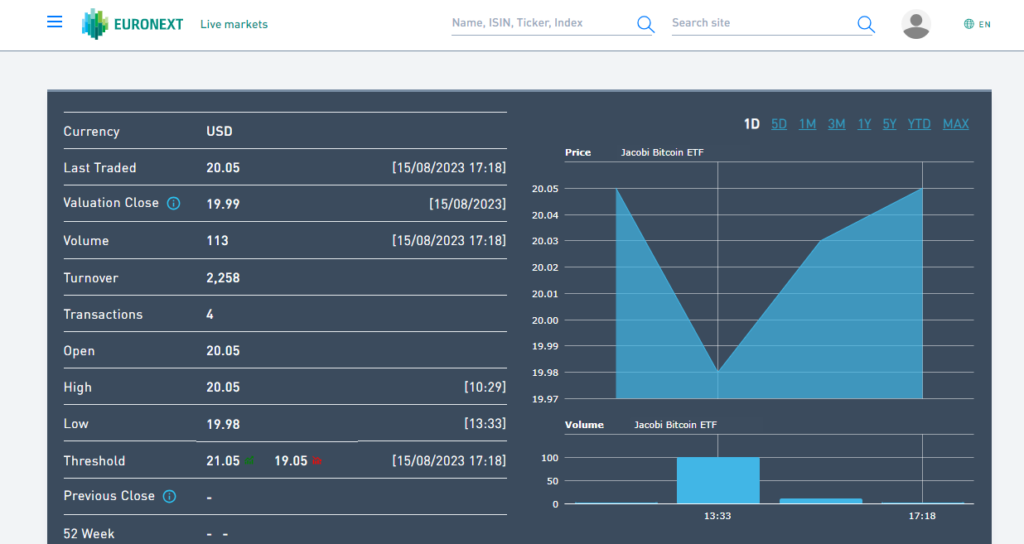

On Aug 15, 2023, they finally launched the ETF after almost 2 years of getting approval. The ETF began trading at the Amsterdam Stock Exchange but witnessed very less enthusiasm with just 113 orders in the first day of trading.

Read More: Jacobi To Launch Europe’s First Bitcoin ETF in July 2023 After Delay.

4. United States of America (USA)

4.1. Ark Invest x 21Shares

Ark Invest and its partner 21Shares were the first ones to apply for a spot Bitcoin ETF for the third time in April 26, 2023. They also claimed that they would be the first recipients of Spot Bitcoin ETF license if such licenses are awarded by the SEC.

Earlier their application was rejected twice in Jan 2022 and April 2022.

Read More: All About Ark Invest Spot Bitcoin ETF

4.2. BlackRock

Recently, BlackRock has filed for spot Bitcoin ETF with the US Securities and Exchange Commission. The custodian for the same ETF will be Coinbase, a well-known crypto exchange.

A trust has been created by the name of iShares Bitcoin Trust to own the Bitcoins.

After SEC’s comments regarding the lack of information around Bitcoin ETFs, BlackRock has made some amendments in its application. The latest one was filed by Nasdaq to the SEC and names Coinbase as a its SSA or Surveillance Sharing Agreement partner.

Read More: BlackRock’s Bitcoin ETF’s Details

4.3. Fidelity

Read More: Fidelity Spot Bitcoin ETF

4.4. Invesco

Invesco was one of the first applicants for a Spot Bitcoin ETF. The $4.2 Trillion asset manager had earlier applied for an ETF license with the SEC.

4.5. WisdomTree

WisdomTree is a $87-billion asset manager based in New York, USA. They specialize in ETFs and similar assets. Their application with the US SEC was filed on June 20, 2023.

Read More: WisdomTree’s Spot Bitcoin ETF

4.6. Valkyrie

Seeing SEC’s comments on Bitcoin ETFs, Valkyrie listed Coinbase as its SSA partner in its application filings for spot Bitcoin ETFs.

Valkyrie also operates two other ETFs related to Bitcoin Miners and Bitcoin Futures.

Read More: Valkyrie Spot Bitcoin ETF

4.7. VanEck

We Anticipate Bitcoin ETFs To Succeed

I have experience of more than 8 years in the world of investing and expect Bitcoin ETFs to pick up the pace once they are just operational. The reason is that it sets the investor free from the hassle while enjoying almost the same gains as if it were purchased directly. The ETF handles the purchasing and securing of cryptocurrencies amid increasing regulatory complexity.

Some Reasons:

- Bitcoin ETFs are easier to invest.

- They do not have security implications of purchasing a normal Bitcoin.

- No need of complex crypto tax calculations as ETFs would be taxed under Capital Gains in several countries.

- No new AML or KYC registrations are required as they can be bought with normal trading accounts.

Expert Comments

- CEO Larry Fink commented on BlackRock’s Bitcoin ETF push by saying that Bitcoin is akin to digitizing gold and it will revolutionize finance.

- Former SEC Attorney John Redd claimed that SEC is not going to amend its position against allowing ETFs. The SEC in a statement dated August 11, 2023, clarified that it delayed Bitcoin ETFs to 2024.